Motorists queue at a Shell petrol station in Nairobi/ Mwakilishi.com

NAIROBI, Kenya Apr 15- Oil Marketing Company (OMC) CEOs face jail terms and fines over the ongoing fuel shortage crisis in the country.

The top executives risk two years in jail or fines of up to Sh2 million for their firms’ role in the current diesel and petrol shortage.

The OMCs have been faulted for breaching a regulation that demands they keep a minimum level of diesel and petrol stocks, which has seen motorists queue at petrol stations for hours on end and travel far and wide in search of fuel.

Government officials blamed the OMCs for the countrywide fuel shortage, accusing them of hoarding supplies ahead of Thursday’s monthly price review, which saw pump prices increase by Sh9.90 per litre from midnight.

The Energy and Petroleum Regulatory Authority (EPRA) announced that in Nairobi, a litre of Petrol will go for Sh144.62, Diesel (Sh125.50) and Kerosene (Sh113.44). This is the highest rate since Kenya began setting tariffs for petrol, diesel and kerosene in 2010, despite the prices factoring in the Government’s fuel subsidy programme.

The State has termed the OMCs actions as economic sabotage, which is a capital offense that carries life imprisonment.

The fines and jail terms linked to stocks are contained in the Energy (Minimum Operational Stock) Regulations, 2008, and underline the government’s resolve to end the fuel shortage that has persisted for three weeks.

Under the law, oil marketers are required to maintain minimum stocks of petrol and diesel to last 20 days and 25 days respectively to cushion the country from supply disruptions.

Firms on the spot

The executives of the 10 firms, including top oil marketers Vivo Energy, Total Energies, Ola Energy, and Gapco Hass Petroleum, are expected to report to the Directorate of Criminal Investigations (DCI) over the economic sabotage claim.

Other managers on the DCI’s radar are Petro Oil, Galana Oil and Lake Oil Petroleum.

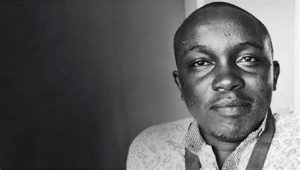

This comes following the announcement that Rubis Energy Kenya CEO Jean-Christian Bergeron was set for deportation over the ongoing fuel shortage crisis.

Energy Cabinet Secretary Monica Juma told a media briefing that Bergeron had left the country on Wednesday night but declined to give further details.

“These (artificial shortages) are not acceptable and will not be tolerated. We cannot hold the nation at ransom. We will go the whole hog to bring all persons and companies who are in breach of their licensing and operating guidelines to book,” Juma said.

She added that the oil marketers committed economic sabotage and threatened the nation’s security by hoarding the fuel.

However, in a statement, Rubis contradicted the State on claims of having deported Bergeron to France, saying the CEO traveled to Paris to brief the head office over Kenya’s fuel crisis.

Rubis Energy Kenya is owned by Rubis Energie, a subsidiary of the Rubis Group which is listed on the Paris Stock Exchange.

Over the past few weeks, oil marketers have come out strongly, blaming the state for the ongoing fuel shortage over subsidy arrears owed to them by the State.

The subsidy was introduced last April to stabilise prices amid suspicion of hoarding.

Delays in the payment of subsidies to the companies by the government have pushed up prices in the wholesale market where oil majors resell fuel to the smaller independent fuel retailers, who control 40 percent of the market.

This has seen the small retailers hesitate to buy the costly fuel, with increased supply of oil majors unable to plug the deficit.

The oil majors were also cautious about increasing supply, uncertain about whether the State would compensate them for fuel not used to calculate Thursday’s monthly price adjustments, which will stay in place for one month.

Juma threatened to reduce import quotas for oil companies that fail to sell their full allocation as the country grapples with a biting fuel shortage.

She said she had sanctioned a process of reallocating the petroleum import capacity and expected the fuel crisis to ease within 72 hours.

“This situation can only be equated to deliberate efforts to sabotage this economy, which constitutes a capital crime,” she said. “The oil marketing companies who sold above their normal local quota during the crisis period will benefit from additional capacity; while those who sold less will have their respective capacities reduced.”

The government also warned that oil marketers that were disgruntled with the current fuel stabilisation scheme should exit the Kenyan market instead of creating artificial shortages.