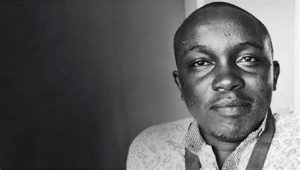

KCB Group CEO Joshua Oigara (right) Chairman Andrew Kairu (centre) and Group CFO Lawrence Kimathi during the release of the full-year result/ Courtesy.

NAIROBI, Kenya, Nov 21– KCB Group has announced plans to buy out a 24 percent stake owned by minority investors in Banque Populaire du Rwanda Plc (BPR) next year.

This follows its acquisition of the bank after buying a 76 percent stake from two shareholders that include Atlas Mara Limited and private equity firm Arise.

Group Chief Executive Joshua Oigara told Business Daily that a full buyout of BPR will cost KCB an estimated Sh6.4 billion, if the minority investors are offered the same terms as Atlas Mara which was paid $33 million (Sh3.7 billion) for its 62 percent stake.

“Our ambition is to acquire the remaining 24 percent in the next year. We are still keen to acquire 100 percent of BPR, the offer is still running. We gave them the offer after Atlas Mara. We are still waiting,” he said in an interview with Business Daily.

Earlier the regional lender had said the plan with the buyout is to eventually create one banking entity in Rwanda to be named BPR Bank by merging KCB Bank Rwanda and BPR.

The combined bank will become the second largest bank in the industry. KCB Group has appointed an integration committee made up of senior executives to spearhead the attainment of the single entity in Rwanda in the coming months.

“This will increase our scale and improve our operating leverage by enabling us to deliver our existing retail and wholesale offerings to a wider base of customers in Rwanda while positioning the bank for sustainable growth in the long-term,” said Oigara during the acquisition announcement.

Oigara added that the merger will provide current KCB Rwanda’s customers with access to a larger network of branches and agents across the country.

KCB is also waiting to buy BancABC Tanzania from Atlas Mara.

“In Tanzania we are waiting for final feedback. It has been delayed a lot. It has taken us a year since we announced it in November last year. We should be able to have a view on Tanzania by the end of this year,” Oigara said.

He also revealed that the lender is also interested in acquiring a bank in the Democratic Republic of Congo (DRC).

The firm posted a 131 percent jump in profits in the nine months ending September 2021 attributed to higher income and economic recovery from the Covid-19 pandemic.

Following the buyout, its total assets increased by 15 percent to Sh1.12 trillion in the nine month period under review.