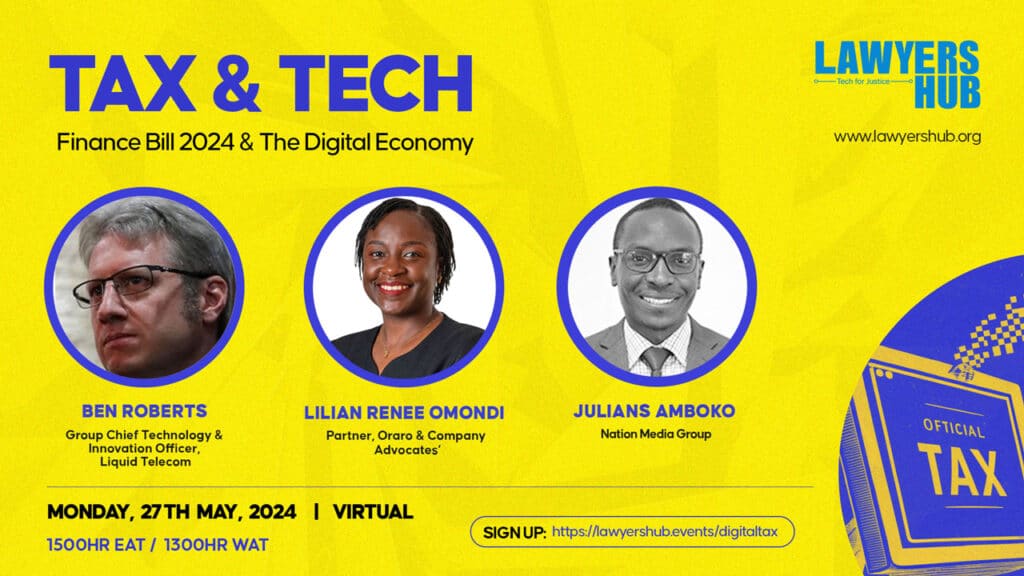

Kenya has introduced the Finance Bill, 2024, which proposes a broad spectrum of tax and administrative measures that will affect various tax laws. These changes, set to take effect on 1 July 2024, are currently open for public participation to gather public views before the Bill is enacted. One of the key areas of focus in this Bill is the digital ecosystem, particularly in terms of digital content monetization and the taxation of income derived from digital marketplaces. The Bill seeks to expand the scope of digital content monetization for income tax purposes, redefining what constitutes a digital marketplace to encompass a variety of online services, from ride-hailing and food delivery to freelance and professional services. The Bill introduces the Significant Economic Presence (SEP) tax, replacing the existing Digital Services Tax (DST). This new tax targets non-resident entities deriving income from services provided through digital marketplaces, imposing a 30% tax on the deemed taxable profit, which is 20% of the gross turnover. Given these substantial changes and more on the Bill, it is crucial for Kenya’s tech and digital sectors to understand the implications of the Finance Bill 2024. The Bill if passed will all have significant impacts on compliance and operational strategies. This event aims to provide a comprehensive overview of the proposed tax changes, their potential impact on Kenya’s digital ecosystem, and practical guidance for navigating the new tax landscape. We are pleased to have an esteemed panel of speakers who will share their insights and expertise on these critical issues. This discussion is part of the public participation process, and we intend to incorporate the insights and feedback from this event into our submissions to the Finance and National Planning Committee. Your contributions are invaluable in shaping the final version of the Bill.