As the licensing process for digital lenders continues, with the coming to effect of The Central Bank of Kenya (Amendment) Act, 2021, the Central Bank Of Kenya is reporting that it has so far licensed 10 out of the 288 applicants, which translates to a mere fraction of the numerous providers in a sector that was awash with service providers.

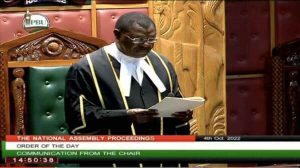

The Central Bank of Kenya (Amendment) Act, 2021, which became effective on December 23, 2021, empowered CBK to license, regulate and supervise digital credit providers (DCPs) to ensure a fair and non-discriminatory marketplace for access to credit.

Earlier that month in December 2021, Parliament enacted The Central Bank of Kenya (Amendment) Act of 2021 effectively providing the Central Bank of Kenya (CBK) with the powers to license and oversight the previously unregulated digital credit providers.

The move has been seen as a timely regulation as the uptake of digital loans in Kenya has been on a steady rise over the years, with borrowers now being able to access credit at the touch of a button through user friendly mobile applications.

According to a 2019 survey by GeoPoll, although the proliferation of mobile-based banking and lending platforms has provided unbanked populations with access to financial services and increased financial inclusion by over 50%, these platforms have become more popular, with 71% of over 4,000 respondents having taken out a mobile loan. The survey further indicated that the majority of those taking out loans are doing so for personal use at 66.5% and 33.5% using loans for business. The survey also showed that there are now over 120 digital lending platforms in Kenya. 88% of those polled also said they would consider taking another loan out in the future.

It is also estimated that in the first quarter of 2020, there were around 10.2 million mobile loan borrowers, up from six million in Q4 2019.

Some of the provisions of the amended Act include requirements that lenders refrain from harassing lenders or threatening them.

At the same time, digital credit providers have been tasked with ensuring that the customer’s consent is obtained before sharing of credit information with a credit reference bureau. The Act also provides for elaborate anti-money laundering measures and provisions aimed at combating the financing of terrorism.

However, despite this rosy picture, audit, tax and advisory firm KPMG sees this bringing about a shift in the way these digital lenders operate. KPMG says one of the major discussion points in the aftermath of the Regulations becoming operational revolves around capacity versus willingness to repay. A system that is driven by the prospects of no rollover and penalty fee ceilings, which has seen many Kenyans become entangled in “poverty traps” of almost perpetual and increasing debt.

KPMG says the need to disburse quick loans with short turnaround times has also driven many digital lenders to focus on the “willingness to repay” aspect. Previously, basic information was obtained from borrowers with minimal initial background checks, whilst unethical debt collection practices were a norm in the sector.

KPMG is also of the view that with the regulations now in force, it is expected that lenders will shift to “capacity to repay ” business models, where borrowers’ creditworthiness, including pricing, will be assessed based on existing credit information.

“It is also expected that, based on the new law, significant investment will go into model development, data protection compliance as well as compliance with corporate governance requirements”, concludes KPMG.