Partner at the Environmental practice at commercial law firm Cliffe Dekker Hofmeyr Kenya Clarice Wambua/ LinkedIn

NAIROBI, Kenya Feb 2- With the increasing recognition of the need to integrate Environment Social and Governance (ESG) in day-to-day corporate operations, it is likely that ESG disclosure and reporting requirements will soon be a mandatory requirement for more and more entities in the different sectors of the economy.

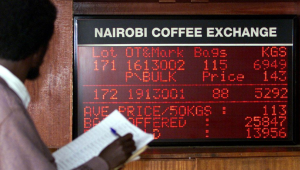

Over the past year, Kenya has seen increased momentum for ESG issues, most recently with the publication of the Nairobi Securities Exchange(NSE) ESG Disclosures Guidance Manual in November 2021.

The Guidelines are aimed at improving and standardizing ESG information reported by listed companies in Kenya and require compliance within one year from their date of publication.

A month earlier, the Central Bank of Kenya (CBK) published its Guidance on Climate-Related Risk Management pushing the banking sector to the frontlines of driving Kenya towards a low carbon future.

The CBK Guidance contains requirements that ensure banking institutions adapt to effectively integrating climate-related financial risks in their management frameworks as well as business decisions and activities.

According to Clarice Wambua, Partner at the Environmental practice at commercial law firm Cliffe Dekker Hofmeyr Kenya, banks will be required to entrench financial risk considerations in their governance systems; include climate change and environment-related financial risks into their existing financial management practices, and develop a disclosure approach for financial climate-related risks.

“This guidance has set out a roadmap for implementation that meets international standards within time-frames that take cognisance of the local context. Requirements may be changed as global best practices on climate risk management evolve, but at least we can begin the process of gradually adopting climate and environmental-related risk requirements,” she said.

The Kenyan Insurance industry has also set up a Taskforce on ESG that will drive and support the readiness of the insurance sector in managing ESG risks and in supporting green finance.

“This aligns with developments early in 2021, when African insurance organisations signed the Nairobi Declaration on Sustainable Insurance, committing to advance the assessment, management, and disclosure of ESG and climate-related risks and opportunities across all lines of business in their insurance practice,” said Wambua.

She added that there is no denying the increasing validity and significance that ESG is playing in daily corporate operations.

“I foresee that ESG disclosure and reporting requirements will soon become mandatory for more industries and entities as the ESG impact of economic activities gathers more traction,” Wambua noted.

For Wambua, this is good news as she highlighted that mitigating the destructive impact of climate change, for example, requires a prompt and objectively measured response at all levels of the economy.

She said that industry can play a critical role to usher in this new low-carbon era as it is guided by state and global requirements, as well as market signals.

By increasing levels of disclosure through the adoption of adequate and objective reporting measures, Wambua believes this will fast-track the transition to a greener economy and boost green investor confidence.

“Through integrated reporting, we can leave no stone unturned by taking everything into account from suppliers to customers to regulators to government, creditors, debtors and investors. There are numerous stakeholders with various interests, so we need to ensure that they are all catered for across the environmental, social, and governance spectrum,” she added.

The current focus on economic recovery and growth requires organisations to remember the fact that ESG considerations are no longer optional checkboxes.

Wambua says they are pivotal to any entity vying for investors – especially international investors.

“It is now all systems go. Institutions must, if they have not already done so, start to put in place the requisite teams, time, and technology to achieve ESG compliance. Those who do it first, win the economic race. But if everyone does it, we win the human race. This is a global imperative and Kenya is committed to change,” Wambua said.