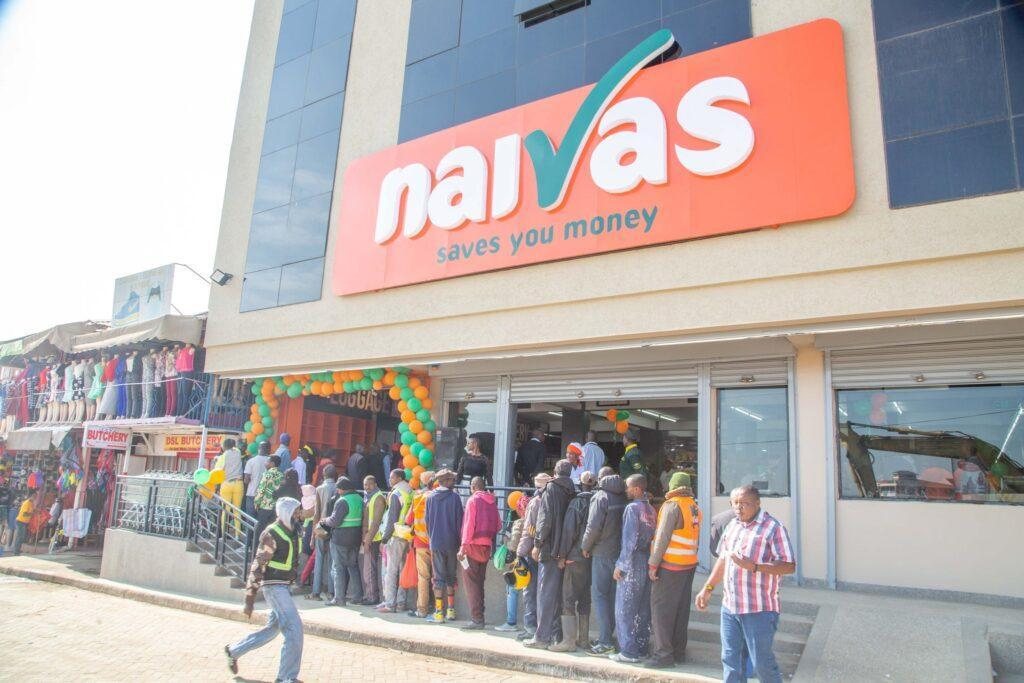

Naivas Supermarket in Ngong Township/Courtesy

NAIROBI, Kenya Dec 6- Naivas Supermarkets is currently in a fresh family battle over ownership of the giant retail chain including proceeds from the sale of 30 percent stake for Sh6 billion.

Newton Kagiri Mukuha- the eldest of the three brothers has renewed his fight over the giant retailer in a row that has seen the High Court block further stake sales in the retail chain.

Kagiri sought a seat on the board, a 20 percent stake in the retail chain, additional shares from the 20 percent stake held by his late father as well as the ouster of his brother David Kimani as the CEO of Naivas.

He also petitioned the court to freeze further share sales in Naivas and for a deposit of the Sh6 billion, which a consortium of investors paid for a 30 percent stake in the retailer in an interest-earning joint account.

Kagiri feels he is entitled to a 20 percent stake worth Sh4 billion from his seed capital that established Naivas and the inheritance of his father’s stake.

The businessman is challenging a High Court ruling of 2014 that found he had no stake in the retail chain after the judge said he ran down all the stores he inherited from his father.

His brothers have previously termed him as a stranger to the retail chain. Naivas has over the past decade climbed from Kenya’s fourth-largest retailer to the biggest supermarket in the country.

This latest feud comes months after Naivas received Sh6 billion from the International Finance Corporation (IFC), private equity firms Amethis and MCB Equity Fund and German sovereign wealth fund DEG for the minority stake, with the deal set to fuel Naivas’ expansion across the country.

The new capital injection in Naivas is earmarked for expansion in the highly competitive supermarket business that has attracted major players, including the Majid Al Futtaim-backed Carrefour franchise as well as South Africa’s Shoprite and Game.

“Court be pleased to issue an order compelling the directors of Naivas to jointly deposit the proceeds of sale of shares to Amethis in a joint interest-earning account pending the hearing and determination of the appeal. Issue temporary injunction restraining the respondent herein and all other directors of Naivas from further sale of shares and assets,” Kagiri said.

Appellant judges David Musinga, Hannah Okwengu and Asike Makhanda agreed to freeze further share sales, but failed to issue orders on Kagiri’s other demands.

“In the meantime, the status quo in so far as the shares in dispute are concerned be maintained pending hearing and determination of the appeal,” said the judges in a ruling delivered on November 25 and made public last week.

Naivas supermarket/courtesy

The fight for control of Naivas went public in November 2012 when Kagiri went to court, seeking orders to stop the sale of the supermarket to South Africa’s Massmart.

Justice Anyara Emukule in 2014 found that Naivas had ceased to be a family business in 1999 when assets that the late Kago – the father of the warring siblings – had accumulated were shared among his children.

Kagiri was offered the Rongai store and a house. His younger brother, Simon Gachwe and sister, Grace Wambui, were given a house and the Elburgon store while David Kimani and his sister, Linet Wairimu, took over the Naivasha business.

Kimani and Gachwe later teamed up to run the Naivasha business and ultimately grew the supermarket into the retail giant that is Naivas.

“Clearly, the objector (Kagiri) has no interest, legal or equitable share, in Naivas Limited,” Justice Emukule said, adding that the family business originally funded by the joint financial efforts and managed under the name of Rongai Self-Service Store with branches in Rongai, Elburgon and Naivasha had ceased to be a family affair upon the signing by family members of the resolution to share the property on October 31, 1999.

Justice Emukule found that Kagiri could only lay claim to part of the 20 percent stake that was allocated to his father.

Kagiri said he had sought court intervention after his siblings, led by Gachwe and Kimani, excluded him from owning a piece of the retail chain.

At the appeals court, Kagiri is pushing for nullification of Naivas shareholding based on court records from his siblings, and the recognition that Naivas was a product of Rongai Self-Service Store.

The businessman is seeking redistribution of his father’s stake after Gachwe and Kimani were offered 20 percent stake each of the late Kago’s shares while the two sisters equally shared the remaining 60 percent ownership.

Naivas has more than 75 stores across Kenya, up from 26 stores in 2013.